This Week: Indices Brace for Fed, Big Tech Earnings, and US PPI Data

- Fed's Jan 28 policy stance sets the tone for the week

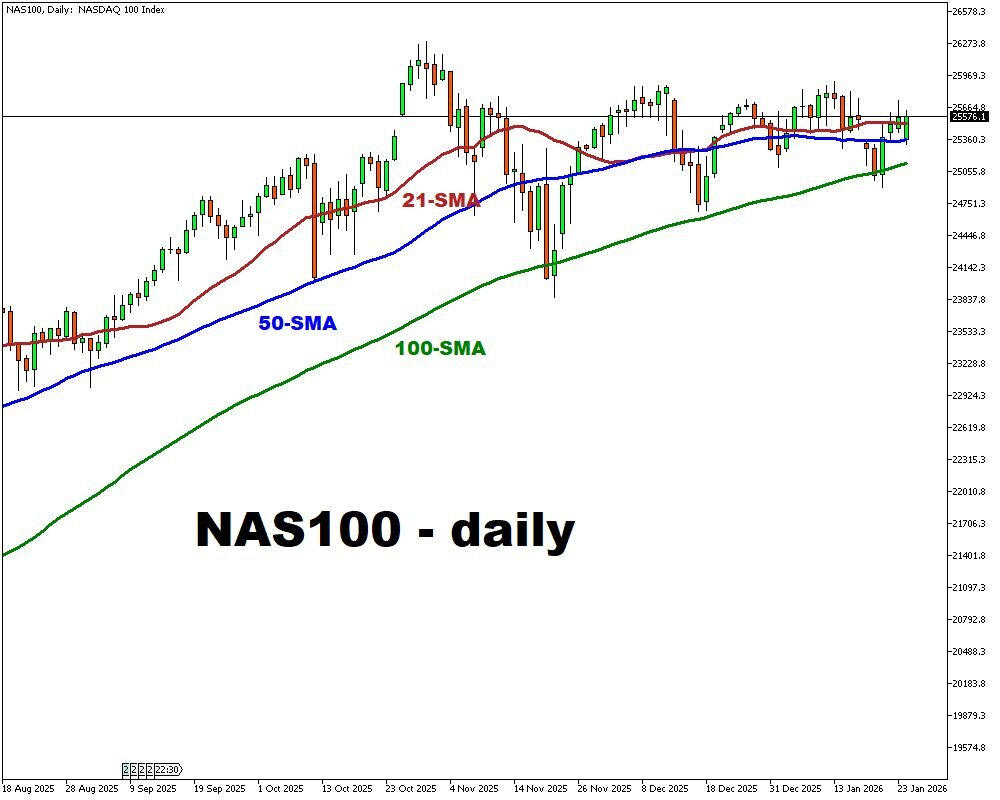

- Big Tech earnings (MSFT, META, TSLA, AAPL) drive US500 & NAS100

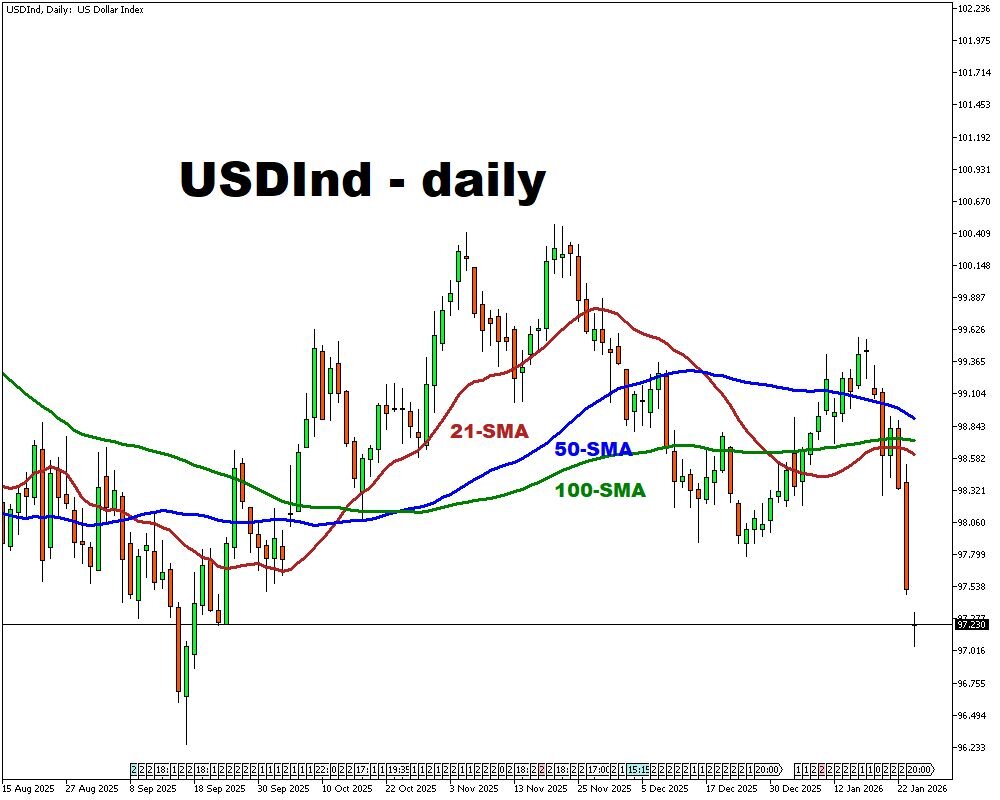

- US PPI reading (Dec) on Jan 30 directs the USDInd

Defining week for U.S. indices will pivot on monetary policy signals from the Federal Reserve and a deluge of mega-cap tech earnings. The US500, navigating investor unease over historic market concentration, enters this critical period.

The performance of major benchmarks, including the NAS100 and the USDInd, hinges on the Fed's stance and whether corporate earnings can offset macroeconomic fears. The week's conclusion, with a crucial US PPI reading, will provide direction for the USDInd.

Events Watchlist:

Wednesday, Jan 28: Fed Rate Decision; Microsoft, Meta, Tesla Earnings – US500

The Fed is expected to hold rates steady. Focus will be on Chair Powell's press conference and post-close earnings from Microsoft, Meta, and Tesla. A hawkish Fed tone coupled with earnings disappointments could pressure US500 lower, while a neutral stance and strong results may lift it.

Thursday, Jan 29: Apple Earnings – NAS100

The NAS100 will react to Apple's earnings after the markets close. As a major index component, strong guidance could help push the index higher, while any weakness may potentially lead to declines.

Friday, Jan 30: US PPI Reading (Dec) – USDInd

The USDInd (US Dollar Index) will find direction from December's Producer Price Index. A hotter-than-expected print could boost the dollar, whereas a soft reading may weigh on the greenback.

Other major events this week:

Monday, Jan 26

- EUR: Germany Ifo Business Climate (Jan)

- USD: US Durable Goods Orders (Nov); Chicago Fed National Activity Index (Oct, Nov, Dec)

Tuesday, Jan 27

- AUD: Australia NAB Business Confidence (Dec)

- FRA40: France Consumer Confidecne (Jan)

- SPN35: Spain Unemployment Rate (Q4)

- MXN: Mexico Balance of Trade (Dec)

- USD: US ADP Employment Change Weekly

- WTI: US API Crude Oil Stocks Change (w/e Jan 23)

Wednesday, Jan 28

- AUD: Australia Inflation Rate (Dec)

- EUR: Germany GfK Consumer Confidence (Feb)

- CAD: BoC Interest Rate Decision

- USD: Fed Interest Rate Decision

- NZD: New Zealand Balance of Trade (Dec)

- WTI: US EIA Crude Oil Stocks Change (w/e Jan 23)

- Earnings: Microsoft, Meta, Tesla (after market close); ASML (before market open)

Thursday, Jan 29

- NZD: New Zealand ANZ Business Confidence (Jan)

- JPY: Japan Consumer Confidence (Jan)

- CHF: Swiss Balance of Trade (Dec)

- EUR: Eurozone Economic Sentiment (Jan)

- SPN35: Spain Business Confidence (Jan)

- USD: US Balance of Trade (Nov); Initial Jobless Claims (w/e Jan 24)

- Earnings: Apple, Visa (after market close), Mastercard (before market open)

Friday, Jan 30

- JPY: Unemployment Rate (Dec); Industrial Production (Dec); Retail Sales (Dec)

- AUD: Australia PPI (Q4)

- FRA40: France GDP (Q4)

- GBP: UK Nationwide Housing Prices (Jan); BoE Consumer Credit (Dec)

- SPN35: Spain GDP (Q4); Inflation Rate (Jan)

- CHF: Swiss KOF Leading Indicators (Jan)

- EUR: Germany GDP (Q4); Germany Inflation Rate (Jan); Eurozone GDP (Q4)

- MXN: Mexico GDP (Q4)

- CAD: Canada GDP (Nov, Dec)

- USD: US PPI (Dec)

Saturday, Jan 31

- CNY: China NBS Manufacturing PMI (Jan); NBS Non-Manufacturing PMI (Jan)