Daily Market Analysis and Forex News

EURUSD touches below 50-SMA amid German CPI and GDP data

- EURUSD touches below 50-period SMA

- Higher-than-expected German CPI at 2.3% YoY

- Negative German GDP at -0.1% QoQ

- Higher volatility could be expected with upcoming EU and US macro data

- Potential ECB and Fed rate cuts in September

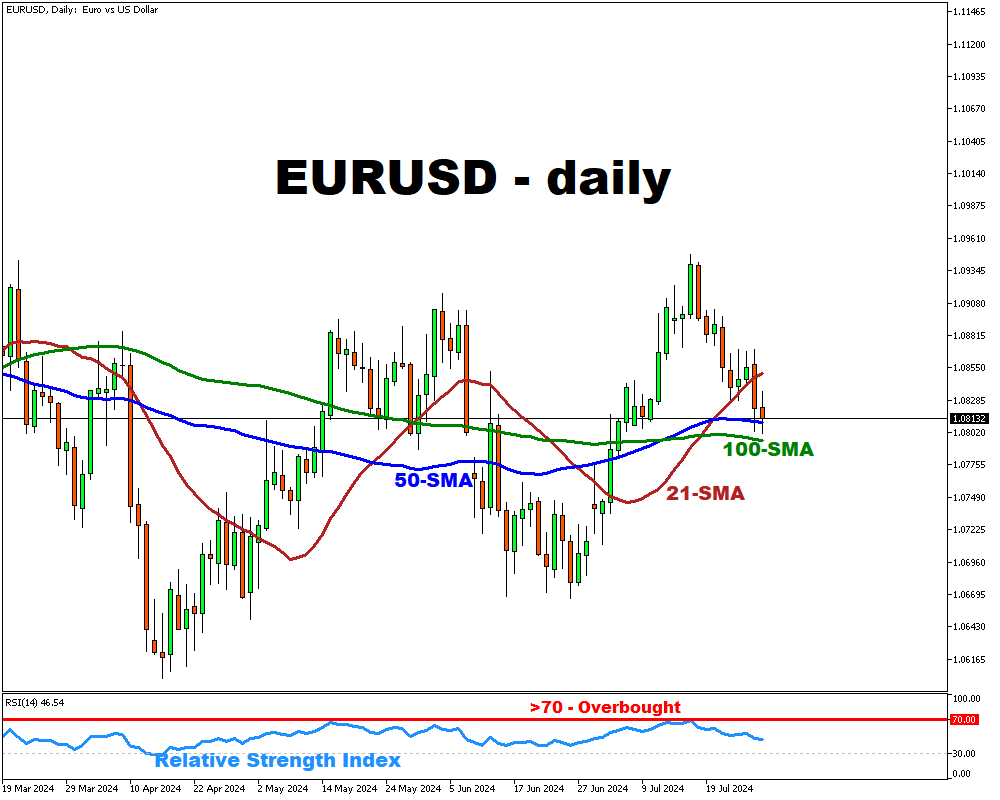

EURUSD has briefly reached below 50-period SMA (~1.081061) despite higher-than-expected German CPI reading (2.3% YoY - actual vs. 2.2% YoY - expected).

However, recent GDP reading for the EU's largest economy has unexpectedly turned negative (-0.1% QoQ - actual vs 0.1% QoQ - expected).

With a number of important EU macro-economic data scheduled to be released this week, we may see a higher level of volatility in the major currency pair.

Key EURUSD centric events to keep an eye on:

- Wednesday, July 31: Euro-Zone Inflation; Fed Interest Rate Decision & press Conference

- Friday, August 2nd: US Non-Farm Payrolls and Unemployment Rate

At the time of writing, investors continue to price in a 25bps rate cut by the ECB in September. ECB President Lagarde has emphasized that policymakers remain "wide open" to the possibility of a cut.

As for the US, the markets are now pricing in a 91.4% chance of a September rate cut (source: CME FedWatch Tool).

From a technical perspective...

The EURUSD has moved lower and is now trading below both its 21- and 50-period SMAs, underscoring a medium-term bearish sentiment.

The Relative Strength Index is floating in neutral territory (<30 - oversold; >70 - overbought), indicating a potential balance between buying and selling pressure.

On the downside, the 50-period SMA may provide immediate support, while to the upside the 21-period SMA could be the key target/resistance level for the EURUSD bulls.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.