Daily Market Analysis and Forex News

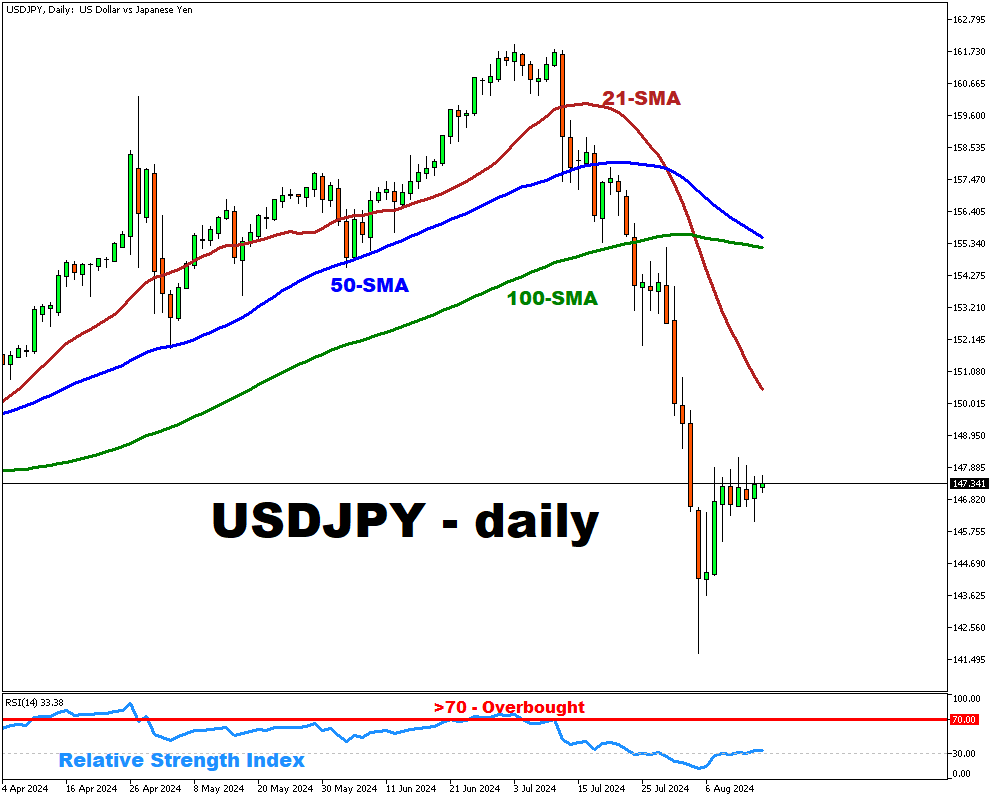

USDJPY remains stronger ahead of US key data

- JP GDP grows 0.8% QoQ, beating 0.5% forecast

- Yen weakens as PM Kishida opts out of re-election

- Soft demand in Japan's 5-year bond auction noted

- U.S. jobless claims, retail data may cause volatility

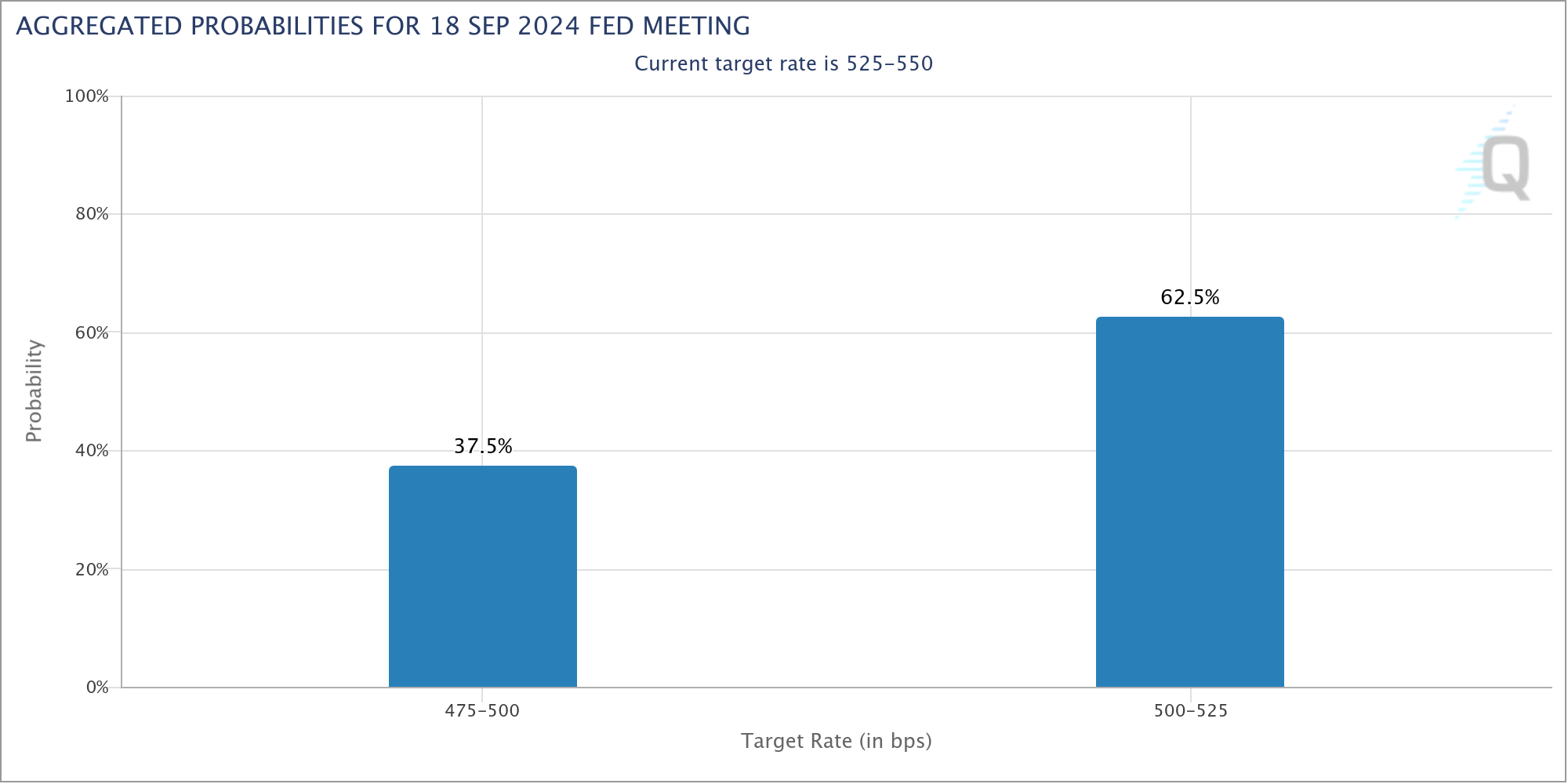

- Market sees 62.5% chance of 25 bps Fed rate cut

USDJPY is ticking higher despite today’s higher-than-expected Japanese GDP figure.

- JP GDP growth rate QoQ: 0.8% – actual vs 0.5% – expected; -0.6% – previous

- JP GDP growth rate ann.: 3.1% – actual vs 2.1% – expected; -2.3% – previous

A continued rise in private consumption could lead to demand-driven inflation and a potentially more hawkish Bank of Japan.

However, the recent unwinding of the USDJPY carry trade has prompted BoJ to halt on further interest rate hikes until the market stability is restored.

A moderate decline in the Japanese Yen came after the Prime Minister Fumio Kishida has officially announced his decision not to run for office for a second term.

Adding to the uncertainty, Japan’s 5-year gov. bond auction showed soft demand, underscoring the impact of the previous rate hike (July 2024).

Investors will now turn switch their attention to today’s US initial jobless claims and retail sales data, scheduled to be released at 12:30PM UTC.

- US Initial jobless claims: 235K – expected; 233K – previous

- US Retail sales MoM: 0.3% – expected; 0.0% – previous

Both readings could contribute to higher volatility in the markets, as well as future Fed policy.

At the time of writing, the markets are pricing in a 62.5% chance of a 25 bps cut (source: CME FedWatch Tool).

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.